- Home

- Investment solutions

- Institutional investors

Institutional investors

As a major player in the real estate investment market in France and Europe, Primonial REIM offers a wide range of skills and expertise to its institutional clients

French and European real estate market expertise

Our strategy is preceded by the macro and micro economic surveys from our Research team which allow us to implement our real-estate convictions.

Our collective real-estate approach is therefore resolutely patrimonial, in that it becomes an integral part of the overall and long-term equilibrium of the portfolios. The majority of our operations are core and core +, which means that they are oriented towards a regular revenue pay-out.

Our collective real estate approach also aims to be specialised. Assets such as office buildings, retail premises, EPHAD (retirement homes) or residential units require asset managers with a thorough knowledge of working with the tenants and specific dynamics associated with each asset class. This is why we have set up dedicated teams for each property asset class. They have thorough knowledge of their sector’s dynamics as well as the practices generally applied in the various French and Euro-zone markets.

This approach ensures that investors who participate in the funds managed by Primonial REIM France can rely on clear investment policies and consequently establish their allocations in a fully informed manner.

Our publications

- Thematic study

Real estate investment, a global perspective

In this study, we want to offer a global perspective on the evolution of real estate markets, explore the diversity of responses provided by international players, and draw the outlines of what could be a “global real estate allocation” in the next cycle.

Our flagship operations

At Primonial REIM France, we have developed leading expertise in the structuring and execution of simple and complex real estate transactions for French and international institutional investors. We offer institutional investors a comprehensive real estate service and tailor-made solutions, adapted to their risk profile and allocation objectives.

Our teams have conducted several emblematic operations, including

SCI Marseille City

SAS Immocare

SAS PREIM Healthcare

OPCI PREIM Défense 2

SCI Lyon Blackbear

SCI PREIM Hospitality

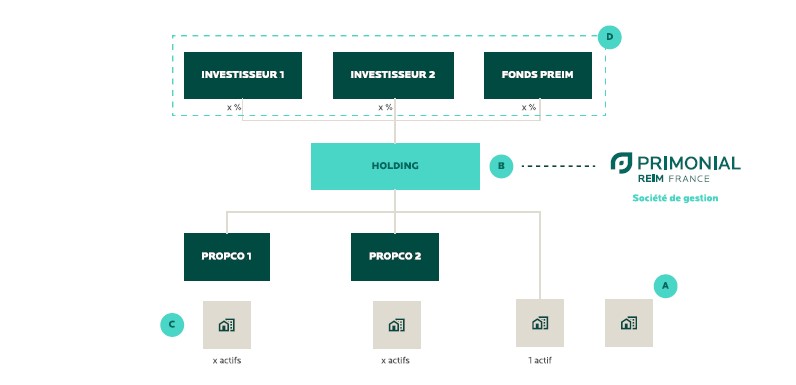

Example of an institutional fund: the club deal

The structuring of real estate investment funds can take the form of club deals, co-investments or dedicated funds. As a management company,

Primonial REIM France takes care of the entire transaction set-up.

Here is an example of a club deal from Primonial REIM France:

a.

Real estate investment

Sourcing (identification of acquisition projects), conducting due diligence, negotiating the terms of the transaction and execution

b.

Structuring the acquisition

Structuring of funds, including bank financing, asset-liability management, performance reporting, monitoring of liquidity and prudential ratios.

c.

Asset Management

Management of the relationship with the tenant(s) and piloting, alongside the property managers and marketers, the proper execution of real estate business plans.

d.

Organization of the governance

Management within the framework of the articles of association or a shareholders' agreement of the life of the fund (governance, decisions, important, liquidity, etc.) until its liquidation

A dedicated team

At Primonial REIM France, we have a team dedicated to institutional investors. Privileged point of contact for our clients, it supports you over the whole structuring of the operation and is in charge of providing you with reports linked to the life of the fund.

et Firefox

et Firefox