Primonial REIM announces the acquisition of the “Sémaphore” building complex from Balzac REIM, on behalf of a number of its investment trusts, for a total of €142.5 M excluding rights.

The property has an ideal situation in Levallois Perret, in a high quality environment in the heart of the Western business quarter. In fact, with 1.5 million m2 of office spaces[1], the Neuilly-Levallois sector is the 3rd largest commercial property centre in the Île-de-France region. The asset is located between the Central Business District and ‘La Défense’ and has excellent public transport access.

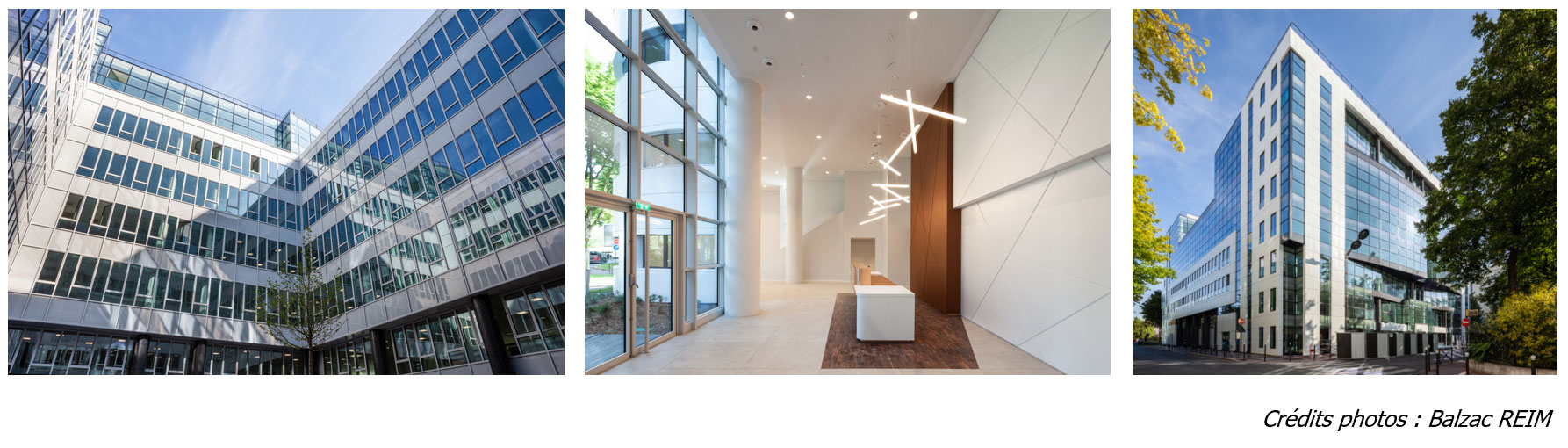

The property was delivered in 2019 after a complete restructuring project, it has a total surface area of 12,100 m2 in office spaces with high quality services: a 150 seat business restaurant, 1,600 m2 floor spaces all receiving direct daylight, 600 m2 of accessible and landscaped terraces as well as high-tech fittings and fixtures. It has a double HQE Renovation - excellent level and BREEAM - good level certification.

The whole of the asset is leased to Doctolib which will occupy the site as of January 2020 with a closed 9 year leasehold.

Grégory Frapet, Chairman of Primonial REIM: “This acquisition successfully illustrates Primonial REIM’s strategy of investing in entirely restructured office buildings located in established commercial districts and able to receive top level tenants such as Doctolib. With this operation we will be able to guarantee further long-term rental income for our client investors. “

For this transaction, Primonial REIM was advised by CBRE, Wargny-Karts and Théop.

[1] Source: Primonial REIM, 2019

About Primonial REIM

Primonial Real Estate Investment Management (Primonial REIM) is a portfolio management company certified by the AMF in 2011; it creates and manages a range of investment schemes based on strong property market convictions. Its main objective is to propose a range of SCPI that invest in office, retail, health/education and residential property to the broadest possible client-base.

As a portfolio management company Primonial REIM sets up and manages OPCI (specifically aimed at either institutional or general public investors). On 10 June 2014 Primonial REIM received AIFM (Alternative Investment Fund Manager) certification from the Autorités des Marchés Financiers (Financial Markets Regulator), and is therefore subjected to strengthened obligations in terms of information, liquidity monitoring and risk management. The Board of Directors includes Grégory FRAPET as Chairman, Stéphanie LACROIX, Managing Director and Tristan MAHAUT, General Secretary.

PRIMONIAL REIM press contacts

primonialreim@edelman.com

07 77 96 24 42

Our latest news

et Firefox

et Firefox