The following information is intended for all associates of the OPCI PREIM ISR (FR0014000AM9, FR0014000AN7, FR0014000AO5, FR0014000AP2, FR0014000AQ0, FR0014000AR8) who have subscribed to shares between January 1, 2023 and March 31, 2023. Any other associate having subscribed outside this period is not concerned by the following information.

What changes will occur in your PREIM SRI OPCI?

We hereby inform you that, due to a material error, the prospectus of the OPCI PREIM ISR has shown erroneous rates for management fees and transaction fees (investment and arbitrage) between January 1, 2023 and March 31, 2023. The rates previously in force, which should have been maintained, were accidentally reduced by a proportion of VAT.

The management company has decided to restore the previous rates. This operation does not entail any change or increase in the risk/return profile. It does not imply any real increase in fees, as it is a simple correction of a material error.

When will this operation take place?

The amended prospectus is effective April 1.

The associates having subscribed shares of the OPCI (all categories included) between January 1st and March 31st 2023 included have thus subscribed on the basis of a prospectus which let appear management and movement fees lower than they are. They are offered the possibility of withdrawing their subscription, free of charge.

If you do not agree with this change, you may redeem your units free of charge until May 31, 2023.

You may exercise this right by sending the custodian or the management company a redemption order accompanied by proof of subscription between January 1, 2023 and March 31, 2023, this right applying only to shares subscribed between these dates.

We thank you for making yourself known to the management company in order to be commercially assisted in your approach, by writing to associes.preim@primonialreim.com.

What is the impact of this change on the risk/reward profile and/or risk/return of your investment? What is the impact on fees?

- Change in risk profile and/or return/risk profile: No

- Increased risk profile: No

- Potential fee increase: No. This is a correction to a posting error. Actual fees have not and will not change.

- Extent of change in risk and return/risk profile: Not significant

What is the impact of this change on your taxation?

This change has no impact on your taxation or that of the fund.

What are the main differences?

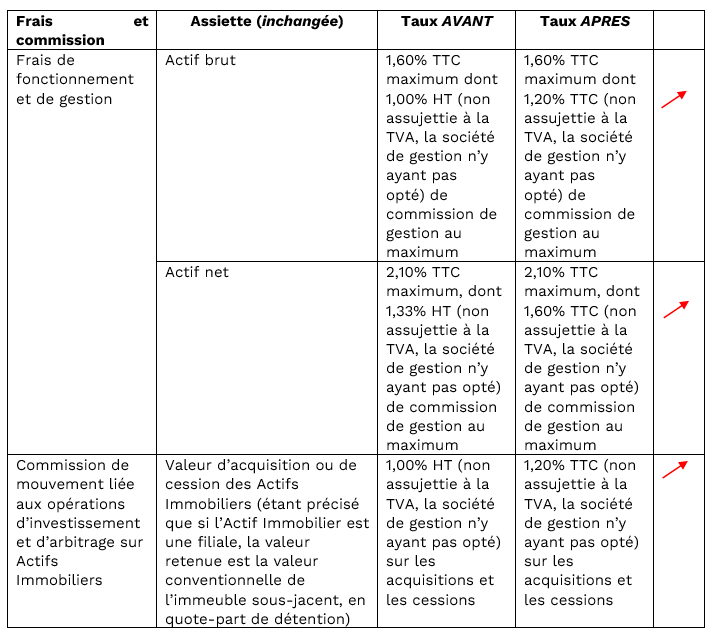

Here are the details of the changes made to your investment:

All share classes except "Institutional":

Institutional" share class only (FR0014000AO5) :

An increase in fees and commissions is a change that does not imply the issuance of a new approval by the Autorité des Marchés Financiers. It has however been submitted to it. The operation does not give rise to the suspension of subscriptions or redemptions.

Key elements to remember for the investor

The management company reminds investors of the need and importance of reading the key investor information document (DICI) corresponding to the category of shares they hold or plan to subscribe to, as well as the prospectus. They are invited to contact their advisor on a regular basis regarding their investments, and to regularly consult the management company's website, which contains a page dedicated to the SPPICAV providing its regulatory documentation, legal reports and various reports.

You can download this press release in PDF format by clicking on this link.

et Firefox

et Firefox