Primonial REIM announces the acquisition, on behalf of the SCPI Primopierre, of the “Le Jour” office building complex from Tishman Speyer. This asset was constructed in 1970 and was completely restructured in 2018, after which it was awarded the Corporate Real-Estate prize at the 2018 Pyramides d’Argent and was nominated for the SIMI Grand Prix in the “Renovated Office Buildings” category.

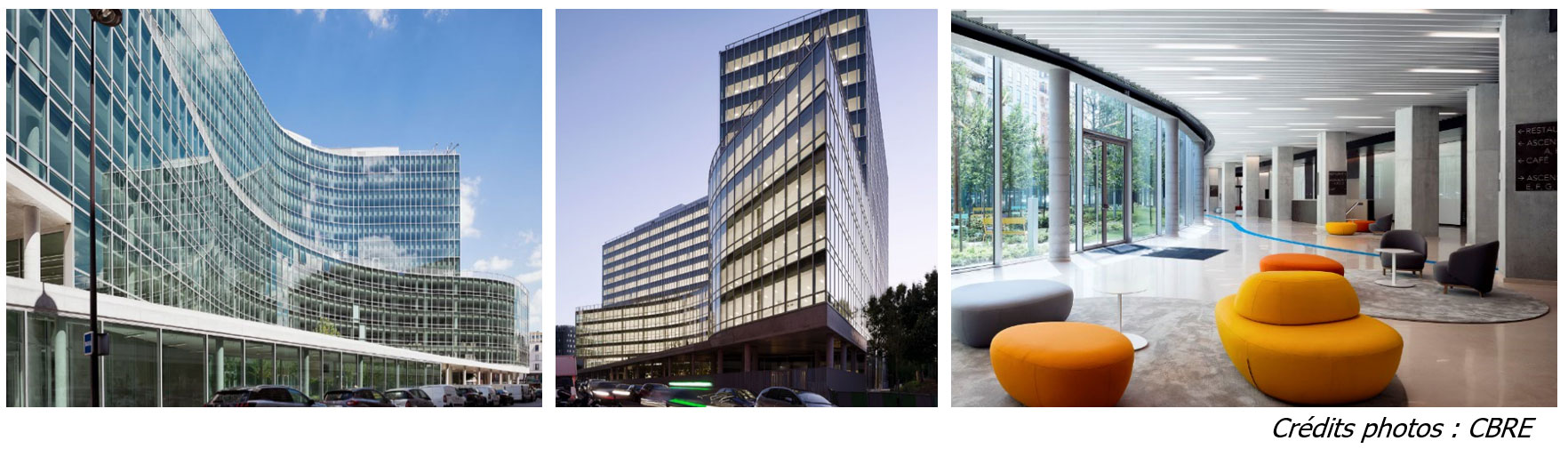

This is a multi-tenant building which offers a good risk spread thanks to a majority of long-term leaseholds. It proposes almost 25,000 m2 of surface area with quality services in line with the latest workspace trends: a fully glazed façade, modular floor-spaces with good height to ceiling, a high-ceilinged reception area and modular meeting rooms. The asset also provides its users with a great number of services such as a company restaurant, concierge services, a modern café, various private meeting rooms, terrace with panoramic views and winter gardens.

The asset has an ideal location in the South of Paris, in the heart of a mixed commercial, retail and residential environment, perfectly integrated into the urban tissue that links up the Montparnasse hub - future high interest area with its many current development projects - and the Grand Paris Express.

The building has high standard environmental performances, with double HQE Excellent and BREEAM Very Good certification and the BBC Effinergie label.

Grégory Frapet, Chairman of Primonial REIM states: “This acquisition fits perfectly with our strategy of investing in assets that meet the requirements of their tenant-users in terms of energy efficiency, usage and services. The building is located in a mixed commercial, retail and residential environment, and will benefit from the urban development projects underway in the Montparnasse, Balard and Porte de Vanves districts. “

For this transaction, Primonial REIM was advised by the LPA & Partners law firm, Etude Alles & Partners, the 7 Concept Engineering and design office as well as the Denjean & Partners and KPMG Avocats law firms.

[1] Source: Primonial REIM, 2019

About Primonial REIM

Primonial Real Estate Investment Management (Primonial REIM) is a portfolio management company certified by the AMF in 2011; it creates and manages a range of investment schemes based on strong property market convictions. Its main objective is to propose a range of SCPI that invest in office, retail, health/education and residential property to the broadest possible client-base.

As a portfolio management company Primonial REIM sets up and manages OPCI (specifically aimed at either institutional or general public investors). On 10 June 2014 Primonial REIM received AIFM (Alternative Investment Fund Manager) certification from the Autorités des Marchés Financiers (Financial Markets Regulator), and is therefore subjected to strengthened obligations in terms of information, liquidity monitoring and risk management. The Board of Directors includes Grégory FRAPET as Chairman, Stéphanie LACROIX, Managing Director and Tristan MAHAUT, General Secretary.

PRIMONIAL REIM press contacts

primonialreim@edelman.com

07 77 96 24 42

Our latest news

et Firefox

et Firefox