- Home

- Investment solutions

Our real estate investment solutions

We offer a unique range of real estate investment solutions, allowing for diversified allocation, to meet the specific objectives of our institutional and retail clients.

In the low interest rate environment we have been experiencing since 2008, coupled with increased volatility in financial markets, investors are looking for solutions that allow them to reduce the overall volatility of their portfolio, diversify it towards real assets, and deliver a regular income over the long term in exchange for a risk of capital loss and liquidity.

This is the vocation of collective real estate as we conceive it. Thus, investment in real estate is relevant within a global allocation and within the framework of a long-term investment.

Our range of real estate investments

Our SCPI (Société Civile de Placement Immobilier) offer

Investments invested 100% in real estate offering potential regular income and/or seeking to increase the value of assets over the long term, in return for management fees.

Our OPCI (Organisme de Placement Collectif Immobilier) offer

A mainly real estate investment aiming at a regular distribution of potential dividends and a long-term valuation.

Our offer available in life insurance

Supports available in real estate units of account.

Institutional Investments

Tailor-made real estate funds for institutional clients according to their investment strategies.

Discover all our solutions

We operate in four sectors: offices, retail, healthcare and education, and residential/hospitality.

SCPI Primofamily

A new way of experiencing real estate

- An SCPI oriented towards everyday real estate: residential/hospitality

- Potential capital gains partly carried by the dynamics of the metropolises

- Investments in France and in the Eurozone

SCPI Primopierre

An asset base mainly composed of offices

- A capitalisation over 3 billion euros

- Majority of the offices in Ile-de-France

- Prestigious tenants

SCPI Primovie

The SCPI that supports all stages of life

- Socially useful activities on a buoyant market

- Investments in France and in the Eurozone

- A capitalisation of over 4 billion euros

Discover our savings solutions available in life insurance

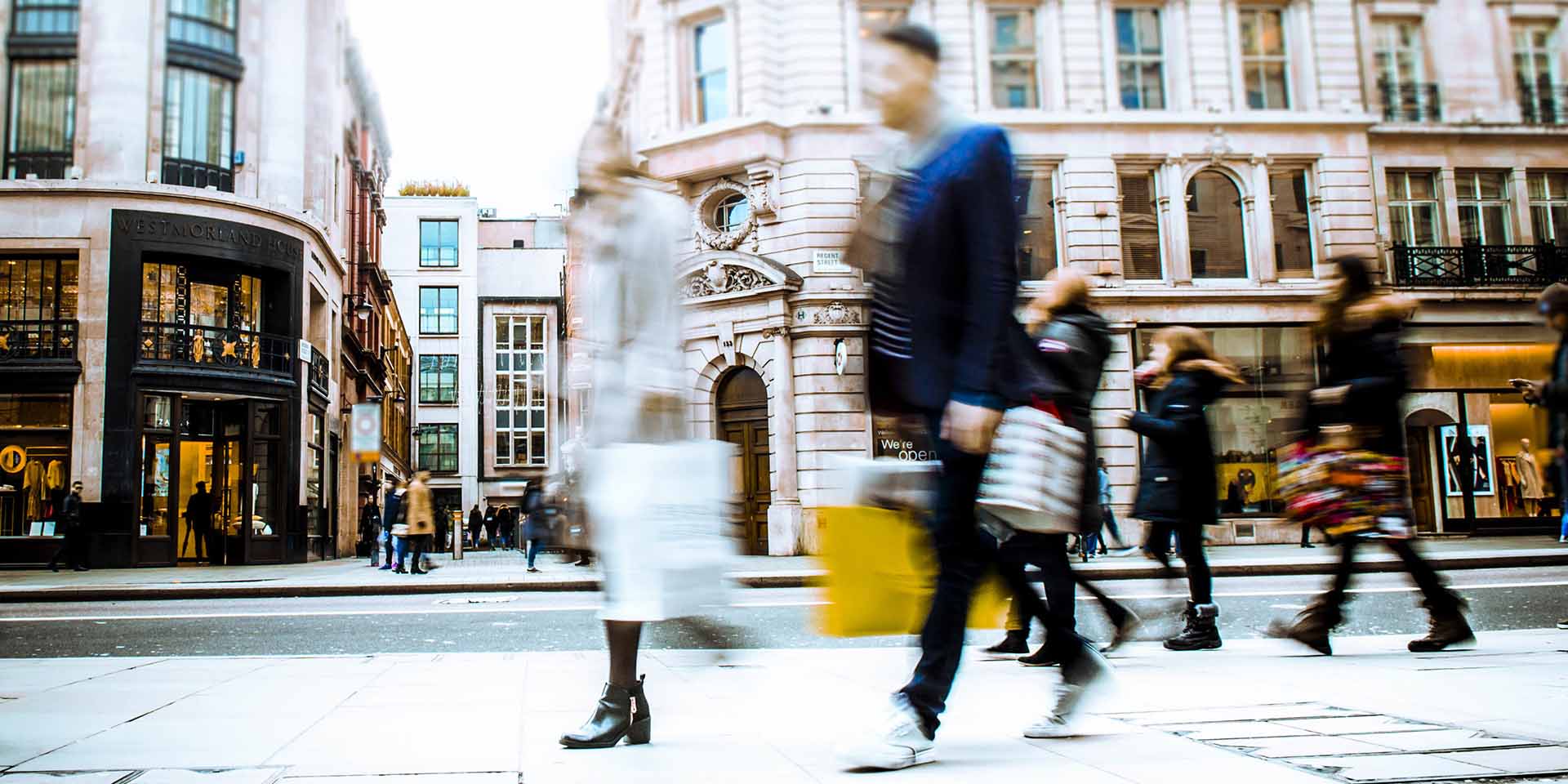

SCPI Patrimmo Commerce

Commercial real estate within reach

- An SCPI for shop buildings

- National and international brands

- Attention given to the quality of locations

SCPI Patrimmo Croissance Impact

Residential real estate in bare ownership

- The 1st SCPI mainly invested in bare ownership

- A social and interim residential asset base

- Buildings mainly for future completion

OPCI PREIMium

A real estate savings plan

- An investment mainly placed in real estate with a section of financial assets

- Savings accessible within 2 months

- Accessible in life insurance and in securities account

OPCI PREIM ISR

A real estate savings solution with an SRI label

- A real estate savings solution accessible with a moderate contribution

- Simplified access to a portfolio of physical office properties

- An SRI-labeled fund based on an exclusive selection process

Institutional investments

Professionals area

- Access to the French and European real estate markets

- Optimised structuring

- Long-term management

The SCPI directly and/or indirectly holds buildings whose sale involves timeframes that depend on the state of the real estate market. The liquidity of SCPI units is not guaranteed by the management company.

As this investment is invested in real estate, it is considered to be illiquid and should be considered from a long-term perspective. The potential income of the SCPI as well as the value of the units and their liquidity may vary upwards or downwards depending on the economic and real estate situation. The recommended investment period is ten years.

Prior to any subscription of SCPI units, the investor must be given the information memorandum, the articles of association, the DIC, the subscription form, the latest quarterly information bulletin and the latest annual report. These documents are available from the management company.

Investing in SCPI units involves risks, including the risk of capital loss.

A real estate of conviction

We manage real estate assets, located in France and in the Eurozone, on behalf of our investor clients. Our portfolio is composed of office, healthcare and education properties, residential buildings, hotels and retail properties.

Our approach is based on conviction-based management, differentiated operating methods for each class of real estate assets and active management based on a close relationship with tenant companies.

Our position as a major investor in the real estate market in France and Europe allows us to detect and receive the best investment opportunities at a very early stage, often before they come to market.

Past investments are not a guide to future investments

Le Lumière

Blackbear

In&Out

West Plaza

Quadrans

Sakura

High Street Retail

Poliscare

Rue de la République

Dueo Galeo Trieo

179 CDG

International School of Milan

Clinique Le Terrazze

Contact Us

Warning

Visualising the following pages requires your agreement to this web-site’s terms and conditions of use. This is why we recommend that, for your own protection and in your interest, you carefully read the “legal information” or the information contained in the “conditions of use and legal notices” and “regulatory information” sections. You accept that you have read and agreed to this web-site’s usage methods as soon as you confirm access to the following pages, regardless of whether you are connected as a professional client or private customer

et Firefox

et Firefox